Law firms, particularly lawyers, face growing challenges when accepting new business requests and the process is an essential part of every lawyer’s responsibility. Fulcrum’s Upfront solution gives lawyers higher levels of confidence in data quality and new business decisions because its intelligent workflow reduces the number of questions lawyers need to answer. It simplifies compliance in areas like AML and KYC, making it easier to adhere to firm policies and external compliance standards. By implementing best practice acceptance pertinent to the firm, lawyers will spend less time registering matters and more time working on them.

The Following ProTips act as an essential guide for anyone looking to revamp and restructure their approach to New Business Intake, regardless of whether you use Upfront or another platform to manage NBI risk.

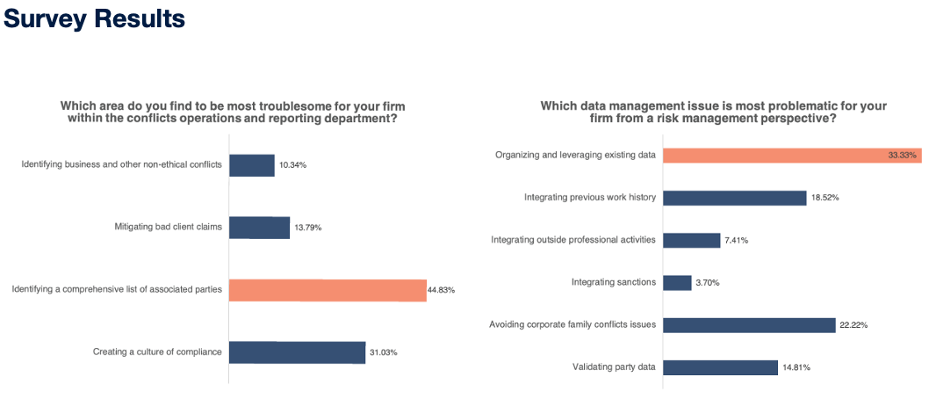

To put into context the challenges being faced currently by firms, below are the results from a recent Fulcrum GT webinar poll detailing the most problematic areas of NBI:

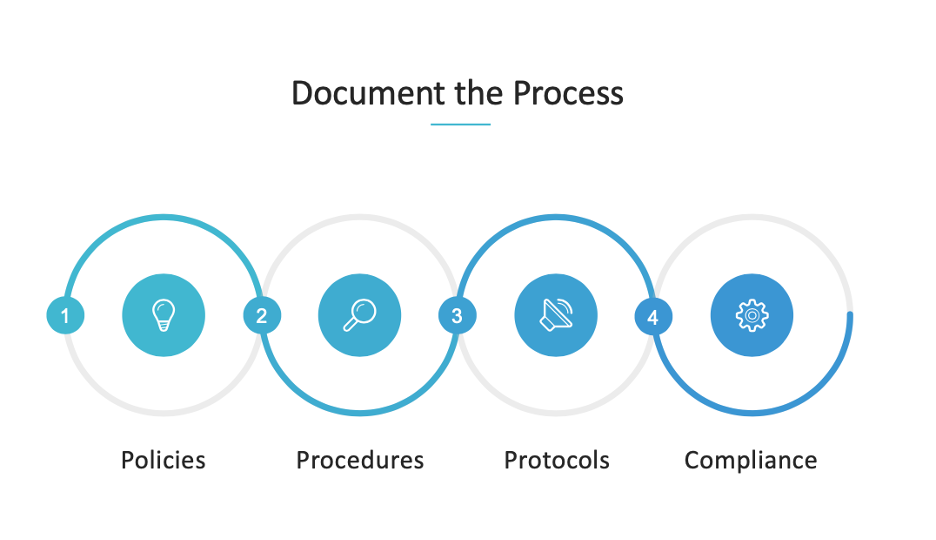

It is important to have a well-documented and defined new business intake process. Ensure your firm has a variety of reasonably current materials – including policies, procedures, and protocols. Your business process should be standardized such that routine is followed regardless of request type. You must have good instructions to accompany the forms that include not just the how, but the why. Furthermore, your turnaround time should be quick enough to reduce impediments to taking in new business to ensure amenability. All of this will promote structure and compliance at your firm.

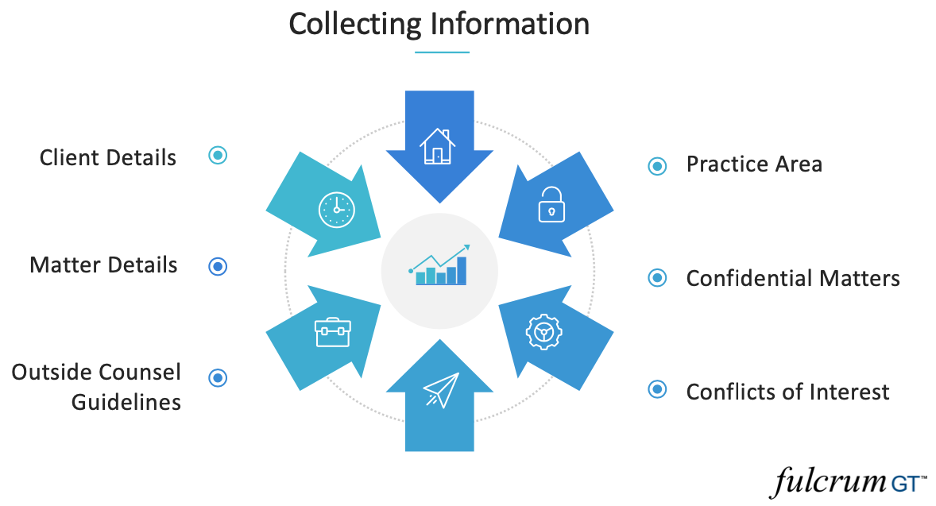

Your intake process should always establish the identity and probity of new clients. Ensure you are conducting adequate due diligence, checking beneficial ownership, and confirming client shareholder information. Furthermore, you should identify any high-risk industries in which a client might practice. To further mitigate risk, you might also check the relevant sanctions lists. The more structured and comprehensive your client due diligence process, the less likely your firm is to run into issues during representation.

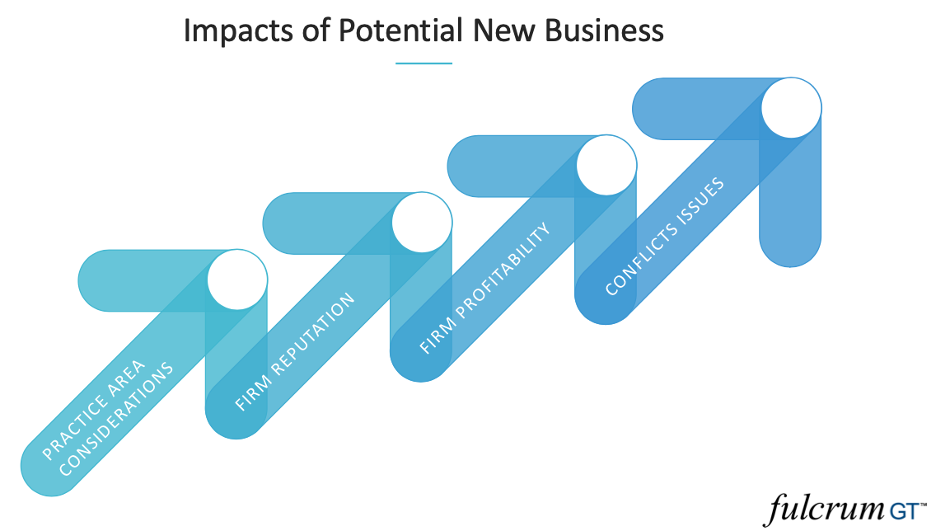

The new business intake process should always assess the impact a new client might have on the firm. This impact can go well beyond ethical conflicts. Make sure your process seeks information that enables stakeholders of the firm to assess commercial or strategic conflicts which can affect existing client relationships.

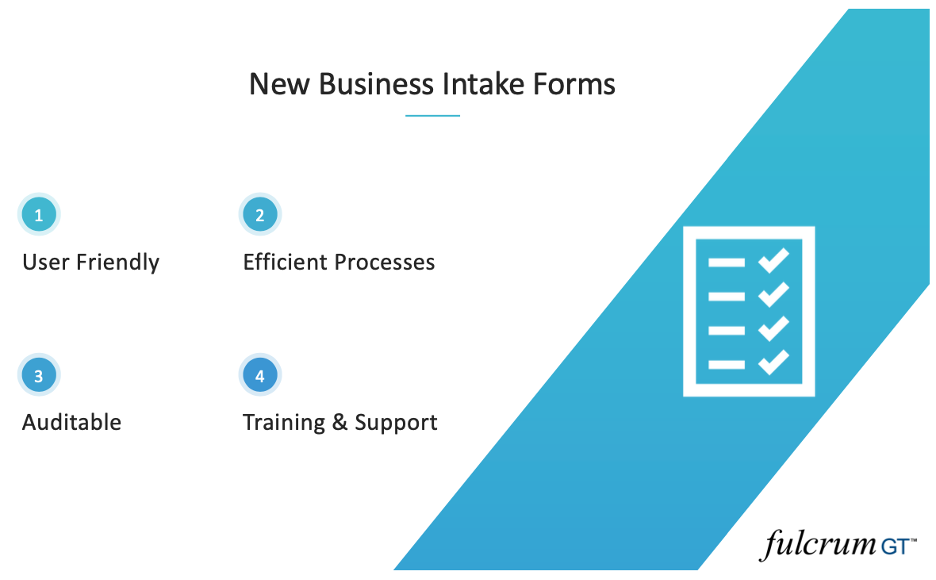

Your new business intake forms should:

- present existing client information for new matters (e.g., lawyer relationships, billing arrangements, addresses)

- present or suppress questions based on region, matter type, and industry sector

- encapsulate stand-alone forms to promote completeness, provide consistency

- present relevant options, improve efficiency, and highlight where client-matter updates are needed

The information gathered in the intake process should be restricted to that which is necessary to open the client and/or matter. Information, specifically that which supports business development should be requested after the client relationship is established or the specifics of the matter are known.

Once a client-matter is opened, the associated information should be officially “owned” and proactively maintained by the responsible administrative department. For example, we recommend the Conflicts function own the official client name, Finance own billing arrangements and lawyer matter relationships, and Business Development own client and matter classification codes (e.g., industry, practice, area of law).

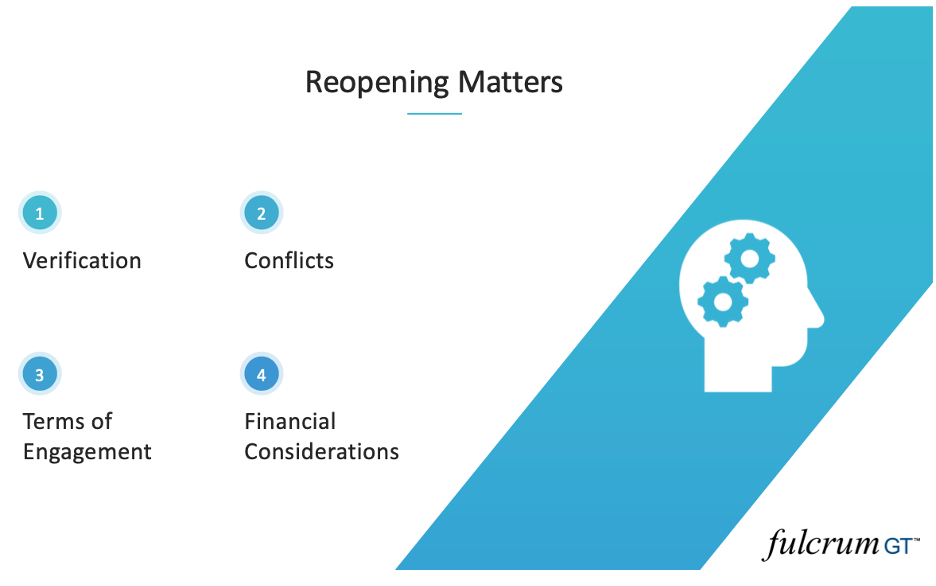

When a client-matter is reopened, the accuracy of the description should be confirmed to ensure the matter has not changed. Moreover, conflicts should be re-checked as should lawyer assignments, fee arrangements, billing arrangements, billing and payment history, and the terms of engagement.Changes to the existing terms of engagement should be reflected in an updated engagement letter.

Based on history of claims paid, conflicts and bad clients claims represent roughly two-thirds of all claims against law firms. Therefore, proper client identification and vetting is equally as important as searching and vetting conflicts. You can incorporate this into your conflicts checking process by making sure your team has the proper tools to know for whom they are searching.

Be sure to take the following into account:

Client identification – such as individual vs. entity, AKAs/FKAs

Background checks – depending on the nature of the proposed representation, identification of client owners or principals

Risk Mitigation – Declining matters if the nature of the client’s business, principals of client, past business dealings or background checks reveal risks that would put the firm in an adverse light, or be client aiding in defrauding others

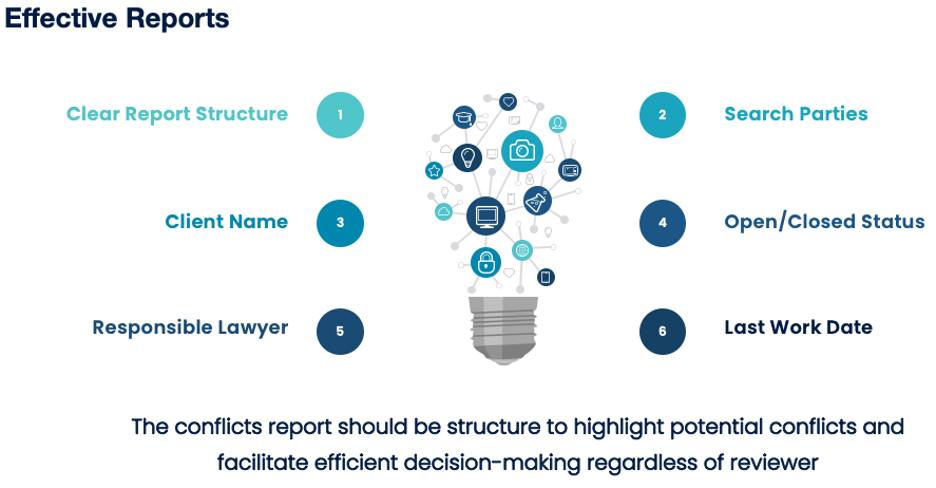

Conflict reports should be organized to highlight potential conflicts and facilitate efficient decision making for partners and staff alike. The structure of conflict reports needs to remain consistent, including the ordering of information, with the most relevant information being called out. Client name and Search Parties are two of the most important items on a conflict report and should be clearly identified. We recommend including the Open and Closed Status of matters asconflicts can depend on matter status and whether a client is a current or former client of the firm. The report should include the Responsible Lawyer for the client/matter, so others know who to contact. We also recommend including the Last Work Date as inactive matters are not always closed in a timely manner, so last time entry date can aid in the resolution of a conflict on an inactive matter.

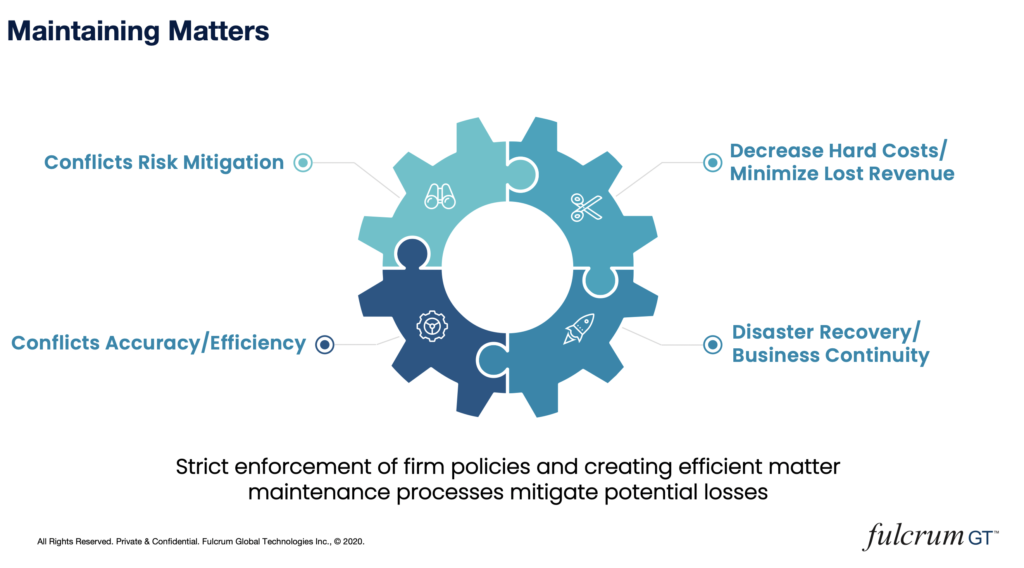

One of the most important issues when maintaining matters is to make sure additional parties that become involved in the matter after it is registered are identified and added to your conflicts database. Giving lawyers a simple means by which to do this is crucial. Failure to properly maintain matters can result in malpractice claims, potential disqualification, and reputational damage to your firm. Dataintegrityis of the utmost importance and maintaining matters should reduce the number of hits to review, speed up clearance time, and increase partner satisfaction as well as compliance.

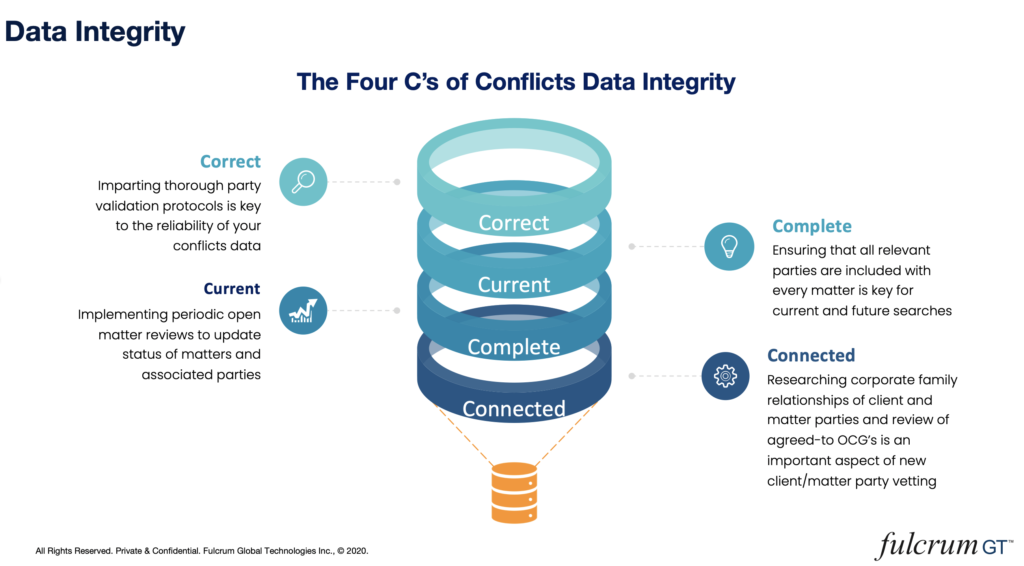

It should be reinforced with everyone at your firm that its data integrity is only as good as the quality and accuracy of the data provided. Data integrity is critical to effective intake and conflicts risk management. Without each of these measures you cannot rely on your conflicts system to mitigate conflicts risk.

Correct: Validating the accuracy and completeness of complete legal names of all parties ensures accuracy of conflicts data.

Complete: Review of all new matter conflict requests, including the matter description, to ensure that all relevant parties to a matter and their appropriate relationship statuses are identified.

Current: Periodic reviews of open matters for readiness for closure or review of any needed updates to open matters.

Connected: Corporate family research and review of clients’ OCG’s regarding their expectations as to corporate family conflicts.

These ProTips have been offered as a means to focus your NBI risk mitigation efforts. In developing our Upfront product, we have designed a sophisticated solution to meet a range of intake and risk management issues. If you would like a demo of our solution or would simply like to gain our advice on your current system and processes, feel free to reach out on the following link to arrange an introductory call:

:format(webp)/f/102444/8000x4501/53e29b2c82/header-connect-bi-622-v1.png)

:format(webp)/f/102444/8000x4501/f451c8829b/header-connect-hcm-622-v1.png)

:format(webp)/f/102444/8000x4501/7bd43e9510/header-connect-time-622-v1.png)